HSA Limits 2022 2022 annual contribution limits, minimum deductibles, and out-of-pocket maximums for health savings accounts (HSAs) are shown below. You can contribute to an HSA if you are covered under a high deductible health plan (HDHP) and meet certain other requirements. 2021/2022 Annual HSA Contribution Limitation The maximum HSA contributions for 2021 and 2022 are: 2021 2022 HSA contribution limit (employer + employee) Individual: $3,600 Family: $7,200 (Plus catch-up

HSA Limits for 2020

HSA Limits 2020 2020 annual contribution limits, minimum deductibles, and out-of-pocket maximums for health savings accounts (HSAs) are shown below. You can contribute to an HSA if you are covered under a high deductible health plan (HDHP) and meet certain other requirements. 2019/2020 Annual HSA Contribution Limitation The maximum HSA contributions for 2019 and 2020 are: 2019 2020 HSA contribution limit (employer + employee) Individual: $3,500 Family: $7,000 (Plus catch-up

HSA Limits for 2019

HSA Limits 2019 2019 annual contribution limits, minimum deductibles, and out-of-pocket maximums for health savings accounts (HSAs) are shown below. You can contribute to an HSA if you are covered under a high deductible health plan (HDHP) and meet certain other requirements. 2018/2019 Annual HSA Contribution Limitation The maximum HSA contribution for 2018/2019 is: 2018 2019 HSA contribution limit (employer + employee) Individual: $3,450 Family: $6,900 Individual: $3,500 Family: $7,000

HSA Limits for 2018

HSA Limits 2018 2018 annual contribution limits, minimum deductibles, and out-of-pocket maximums for health savings accounts (HSAs) are shown below. You can contribute to an HSA if you are covered under a high deductible health plan (HDHP) and meet certain other requirements. 2018 Annual HSA Contribution Limitation The maximum HSA contribution for 2018 is: 2018 HSA contribution limit (employer + employee) Individual: $3,450 Family: $6,900 2018 High Deductible Health Plan

Beware of Short-Term, Limited Benefit Health Plans

The Virginia Bureau of Insurance recently issued a warning to Virginia residents to beware of high-pressure telemarketers selling short-term or limited benefit health insurance policies. We could not agree more. If you’re shopping for individual/family health insurance between February and November, be careful! These months fall outside open enrollment — the set time each year when anyone can buy Affordable Care Act (ACA)-compliant health insurance, for any reason. Unless you

Understanding Health Insurance

How Well do You Understand Health Insurance? A recent study evaluated how well Americans think they understand health insurance vs. how well they actually understand health insurance. It turns out that although about three-quarters of people surveyed believe they know how to use their health insurance, only about 20 percent could correctly calculate the amount they would owe for a doctor’s visit. In addition, many did not understand key terms

Metal Plans Under the Affordable Care Act

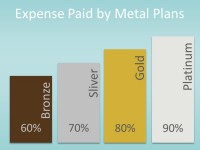

The Affordable Care Act (ACA) created four new designs for health insurance policies. You may have heard policies referred to as “metal plans.” This is because each design is named after a metal: Bronze | Silver | Gold | Platinum The four metal plans are distinguished from one another by their actuarial value. Actuarial value (AV) is the average amount of covered health care expenses that will be paid for

What Types of Health Insurance are Out There?

How will you make the best choice for your health insurance? By understanding your options! Here is a high-level review of the different types of health insurance plans. The right fit is different for each individual. So please give our office a call to discuss which type of plan may be best for you! Health Maintenance Organizations (HMOs) and Exclusive Provider Organizations (EPOs) Coverage is limited to a certain list

What is a Health Savings Account (HSA)?

(This post was originally published in May 2013 and was updated in Nov 2016, Oct 2017, May 2018, Aug 2018, Nov 2019, May 2020, June 2021, May, 2022, and September, 2023) When you have insurance coverage through a high-deductible health plan (HDHP), you may establish a Health Savings Account (HSA). An HSA is an account into which you deposit money to pay for medical-related costs. There are many benefits of

What is a High-Deductible Health Plan?

(This post was originally published in May, 2013 and was updated in Nov 2016, Oct 2017, Aug 2018, Nov 2019, May 2020, June 2021, May 2022, and September 2023) A high-deductible health plan (HDHP) is just what the name implies. It is a health insurance plan that has a higher deductible than traditional insurance plans. An HDHP also has lower premiums than traditional coverage. In plain English, when you’re covered