People often ask this question. And with just cause. After all, it seems pretty straightforward to go online, click a few boxes, and purchase health insurance. Or, if your employer offers group coverage, you simply read the employee handout and make your selection. But, without professional advice, can the average person really understand all of the provisions of an insurance plan and navigate an often-complicated claims process? Sometimes, it takes

Controlling Your Own Health Care Expenses

Wishing there was a way you could control your own health care expenses? We came across two interesting pieces in last week’s news that could mean help is on its way. First, the Centers for Medicare and Medicaid Services (CMS) released the results of a study which reveal enormous discrepancies in the fees hospitals charge their patients. Click here to read more, and be sure to check out the interactive

What is an Employer’s Obligation to Notify Employees about Affordable Care Act?

The Affordable Care Act adds a new provision to the Fair Labor Standards Act, mandating that employers provide notification — in writing — to their employees: Informing the employee of the existence of the Marketplace (referred to in the statute as the Exchange) including a description of the services provided by the Marketplace, and the manner in which the employee may contact the Marketplace to request assistance; If the employer

Healthy Spring Activities

Our experience helping thousands of clients get the right insurance coverage over the years has taught us firsthand that maintaining a healthy lifestyle is one of the best things you can do to manage the cost of health care. Springtime is a great time to take advantage of the nice weather and enjoy some outdoor activities. Here are some great ideas to consider: hiking/walking biking golfing planting and gardening throwing

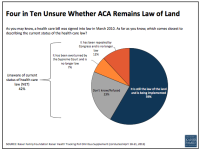

Concerned about Affordable Care Act?

If you answered yes to the question above, then you’re not alone. The buzz in the news is that individuals, small business owners, lawmakers, and insurance companies themselves are all concerned — and unsure — about how the provisions of the Affordable Care Act (ACA) will possibly be implemented by the first of the year. There is talk of… initiating summer campaigns — both from the government and from insurers

The ins and outs of Grandfathered Health Plans

You may start hearing the term “grandfathered plan” as we get closer to 2014 and the next phase of the Affordable Care Act (ACA). As you begin to plan ahead, it is important that you understand what a grandfathered plan is. Here’s what you need to know: What is a Grandfathered Health Plan? A grandfathered health plan is one that was in effect prior to March 23, 2010. If a

What Does “Standardized” Health Insurance Mean?

Anyone who has purchased health insurance knows that understanding the difference from one plan to the next can be very confusing. Plans offer different benefits, different levels of deductibles and co-pays, in network vs. out-of-network care, etc. In order to make it easier for consumers to understand and compare insurance options, the Affordable Care Act (ACA) sets up four (4) levels of insurance: bronze, silver, gold, and platinum. All four

Making Insurance Affordable

In an earlier post we defined adequate and affordable health insurance, noting that beginning on January 1, 2014, the Affordable Care Act (ACA) states that those people whose employer does not offer adequate and affordable group coverage will be able to purchase insurance on the exchange. One of the ways the new law attempts to make insurance “affordable” is through government subsidy for plans bought on the exchange. Last week,

Define “Adequate” and “Affordable” Insurance

Individuals whose employer does not offer adequate and affordable employer-sponsored group coverage will be able to purchase individual health insurance in the exchange. What exactly is adequate and affordable insurance? Adequate Coverage The employer-sponsored plan must cover at least 60% of a person’s medical costs on average Affordable Coverage Insurance premiums can be no more than 9.5% of an employee’s household income Not sure if the health plan offered through

In the News: Affordable Care Act

Tuesday of this week was a big day in the news for those of us watching developments in the implementation of the Affordable Care Act (ACA). Here is a quick summary: President Obama released a much shortened version of the application for health insurance. If you have been following Virginia Medical Plans on Facebook or LinkedIn, then you remember we unveiled the preliminary draft back in March, which was a