Are you a small business owner considering whether or not to provide health insurance for your employees? Although it is not mandatory, offering health insurance benefits small business owners by: helping to attract and retain employees making the business eligible for a possible tax credit In a recent post on this site, we provide a detailed explanation of how the small business tax credit for health insurance works. Estimate Your

What is the Definition of a Tax Household for Health Insurance?

Under the Affordable Care Act (ACA), eligibility for a premium tax credit (also called a subsidy) is based on the income earned by members of your household. Click here to access a chart showing income levels for subsidy eligibility. Who Counts as Part of Your Tax Household? In general your tax household includes anyone for whom you claim a personal exemption on your federal tax return: Yourself Your spouse Your

How do I Calculate My Income to Find Out if I am Eligible for a Health Insurance Subsidy?

Under the provisions of the Affordable Care Act (ACA), some Americans will be eligible for a subsidy to purchase health insurance through their state’s exchange (or the federal exchange for states like Virginia who have chosen not to run their own exchange). Eligibility for the subsidy is determined in part by household income, relative to the Federal Poverty Level. Click here for details. Some are wondering, however, how to calculate

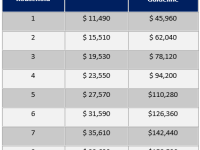

Are You Eligible for a Health Insurance Subsidy?

Update October 2014 – Revised income figures for determining eligibility for 2015 coverage. Click here. Here is a chart to help you determine if you qualify for a health insurance subsidy. (Click here to view larger) Give us a call! We can tell you for sure AND help you obtain the subsidy when you buy your health insurance through the exchange.

What Happens if I Do Not Have Health Insurance after January 1 2014?

The individual responsibility clause of the Affordable Care Act (ACA), also known as the individual mandate, requires all Americans to have health insurance by January 1, 2014, or pay a penalty tax. How will the Penalty Tax be Collected? The penalty tax will be collected by the Internal Revenue Service (IRS). When you file your taxes, if you have a gap in health coverage for a continuous three-months or more