Are There Any Winners Under the Affordable Care Act (ACA)?

The short answer is YES. Many Americans — millions in fact — will be better off because of the new law.

Let’s look at it strictly by the numbers.

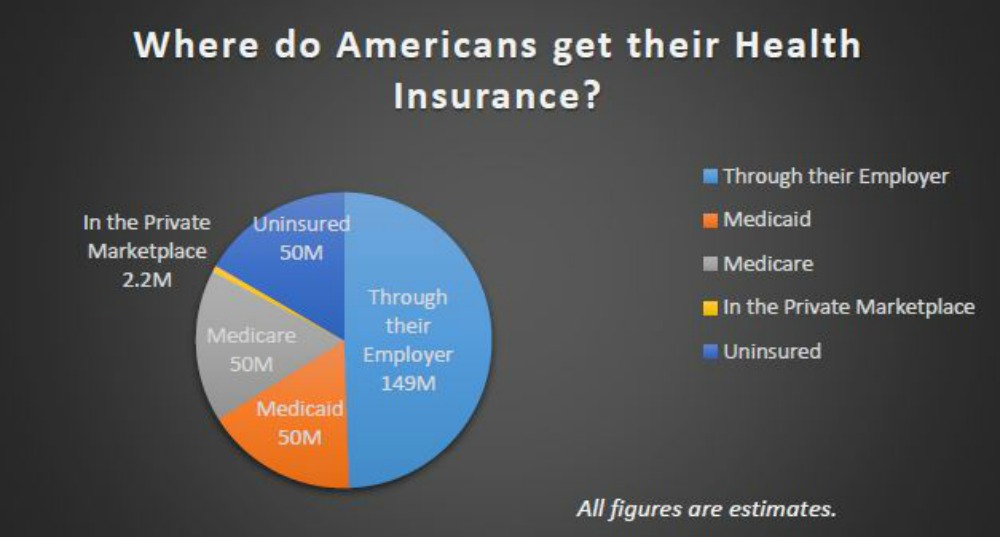

The population of the United States is approximately 300 million. Here is a breakdown of the health insurance status for Americans today:

Some points to consider regarding Americans who currently have health insurance (vs. being covered by Medicaid or Medicare):

The 149 million Americans who get insurance coverage from their employer fall into two categories based on the size of the company:

- Large employer (51+ employees): People in this category are not feeling too much impact from ACA — particularly those in very large companies (over, say, 100 employees).

- Small employers (2-50 employees): People in this category are affected — some for the better, and some for the worse. This depends upon the makeup of the employees in the group (age, health status, etc.).

Many of the approximately 2.2 million individuals who purchase their own health insurance in the private marketplace (as well as many small employer groups) have received cancellation notices. For some, this has caused great hardship. After all, those who may have made sacrifices in order to afford comprehensive health insurance coverage may now be losing that coverage (or having to pay more for it). Relatively speaking, many people in the individual (and small business) market are worse off under ACA. You could say they are the so-called losers in all of this.

The Winners Under ACA – the Uninsured and the Underinsured

But there will be winners too.

Again, looking strictly at the numbers, there are approximately 50 million uninsured Americans. The uninsured, plus those that are underinsured, have the potential to be better off under ACA.

Let’s take a look at why these groups need help.

Uninsured Adults

It is no secret that the uninsured, as a group, tend to be less healthy. By some estimates, uninsured adults (not including those covered by Medicare) are almost two times as likely to report being in fair or poor health as those who have insurance. Almost a third of all uninsured non-elderly adults have a chronic condition. People in this group who do not have access to employer-sponsored coverage cannot afford the high cost of an individual plan, and therefore go uninsured (remember, pre-ACA pricing makes it more expensive to insure someone with health problems).

And so begins a vicious cycle. An uninsured person who can’t afford a visit to the doctor for treatment or to buy medications that may improve his or her condition simply gets sicker and sicker.

The subsidies created by ACA, plus the pricing structure of plans under the new law, will provide the uninsured better access to affordable insurance.

Uninsured Young Adults (ages 19-25)

Young adults feel invincible and therefore are less likely to spend the money for health insurance. But, like all of us, they are susceptible to sudden illness or injury. Without health insurance, they can get into trouble very quickly.

Under ACA, many young adults can remain on their parents’ health insurance until age 26. Those that cannot may qualify for subsidies. (Click here to read more about coverage for young adults under ACA.)

Underinsured

There are also millions of people who are underinsured. These are people for whom the coverage they do have does not adequately meet their medical needs. They may have been mislead into buying policies with high deductibles or other out-of-pocket expenses which they cannot afford. Or they simply did not understand what they were buying.

Subsidies and new pricing will help the underinsured afford policies that meet their medical needs.

The Importance of Health Insurance

At Virginia Medical Plans, we know the importance of health insurance in people’s lives. After all, helping people find the right coverage for their needs is what we do.

Despite there being some losers under the new law, expanded access to affordable health insurance has the potential to yield many winners.

If you need guidance as to your best option for health insurance, give us a call.

Please be patient as we manage a high volume of calls and emails.