If you purchased health insurance on the exchange and collected a subsidy (in the form of a tax credit) to help pay for coverage, or benefited from other cost-sharing reductions, you were able to do so because of the income you reported when you purchased your plan. But if you are like many Americans, the income you anticipated and reported to the exchange may differ from the income you actually

King v. Burwell — What Will Happen?

It’s the middle of June. And while that may have you dreaming of flip flops, sunglasses, and summer, here at Virginia Medical Plans (and in the circles we travel), all eyes are on the King v. Burwell case. By the end of this month we should know whether or not the Supreme Court of the United States (SCOTUS) will strike down subsidies on the federal health insurance exchange based on

5 Tax Tips on Health Insurance for the Self-Employed

Are you self-employed or thinking of becoming self-employed? The Affordable Care Act has made health insurance available to anyone — regardless of current medical status. This means you can purchase coverage for yourself and/or your family on the individual health insurance market — even if you have a pre-existing medical condition. But did you know today’s tax code can save you money if you’re self-employed and you buy health insurance?

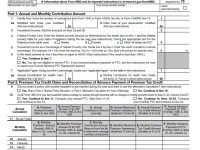

Tax Filing with the Affordable Care Act

With January behind us, it’s time to start thinking about filing your 2014 income taxes. By now, you should have received most, if not all, of your tax forms and notices from your employer(s), banks, mortgage company, financial institutions, etc. — and, if you bought health insurance on the exchange — the Marketplace. As we posted several weeks ago, the upcoming tax season promises to be complicated for those who

King v. Burwell — Will the Supreme Court Do Away with Subsidies?

If you live in Virginia, an upcoming Supreme Court decision may have you wondering if your health insurance subsidy is in jeopardy. Last year several lawsuits were brought against the government challenging the authority of the IRS to distribute health insurance subsidies to people who buy their coverage on the federal exchange (aka healthcare.gov). The issue was whether or not the language in the Affordable Care Act — which refers

How Will the Affordable Care Act Affect my Taxes?

Have you started thinking about filing your 2014 taxes? April 15 may be a few months away, but this year — the first year the Affordable Care Act (ACA) is in effect — filing taxes will be more complicated for millions of Americans. That’s because certain provisions of the new law — namely, penalties and subsidies — will be reconciled at tax time. If you got health insurance through your

Meeting the Dec 15 Deadline to be Covered by January 1, 2015

While we are closing in on the DECEMBER 15 DEADLINE to purchase JANUARY 1 COVERAGE — Please use our QUICK GUIDE to get started on enrollment right away. We are available by phone to help (703-707-8270 or 1-888-396-2341). Our email boxes are overflowing, so please — do not use email! Follow the steps in the guide to determine first if you will be eligible for a subsidy. From there,

Enrolling in 2015 Health Insurance with Aetna Virginia

Instructions for Enrolling in a 2015 Off-Exchange Policy with Aetna Virginia If you have not yet purchased 2015 health insurance, there is still time and we can help! If you live in Northern Virginia — Alexandria City, Arlington County, Fairfax County, Fairfax City, Falls Church City, and Loudoun County — click here. If you live elsewhere in Virginia and would like to enroll in an off-exchange policy with Aetna Virginia

Applying for 2015 Health Insurance With a Subsidy in Virginia

We are in the throes of 2015 Open Enrollment! This means we are working around the clock to help our clients enroll in 2015 coverage. We appreciate your confidence and patience as we manage a high volume of calls and emails. But here is a way you can get started instantly, with no wait: NEW! this year, we are thrilled to offer expedited enrollment for Virginia residents who are eligible

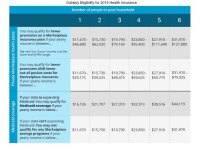

Am I Eligible for a Health Insurance Subsidy in 2015?

Eligibility for a subsidy on your health insurance is determined based upon your household income level and the number of people in your household. The eligibility numbers have been adjusted for 2015 coverage. Here is the most recent data: (Click here or on the image to view larger.) Source: healthcare.gov Virginia Medical Plans Can Help Give us a call at 1-800-867-0800 or send us an email at jkatz@vamedicalplans.com. We can