If you bought health insurance in 2014 through the federal health insurance marketplace (aka, healthcare.gov) AND you collected a subsidy from the government to help you pay for your coverage, then you should have received a tax form 1095-A in the mail during late January or early February, 2015.

If you bought health insurance in 2014 through the federal health insurance marketplace (aka, healthcare.gov) AND you collected a subsidy from the government to help you pay for your coverage, then you should have received a tax form 1095-A in the mail during late January or early February, 2015.

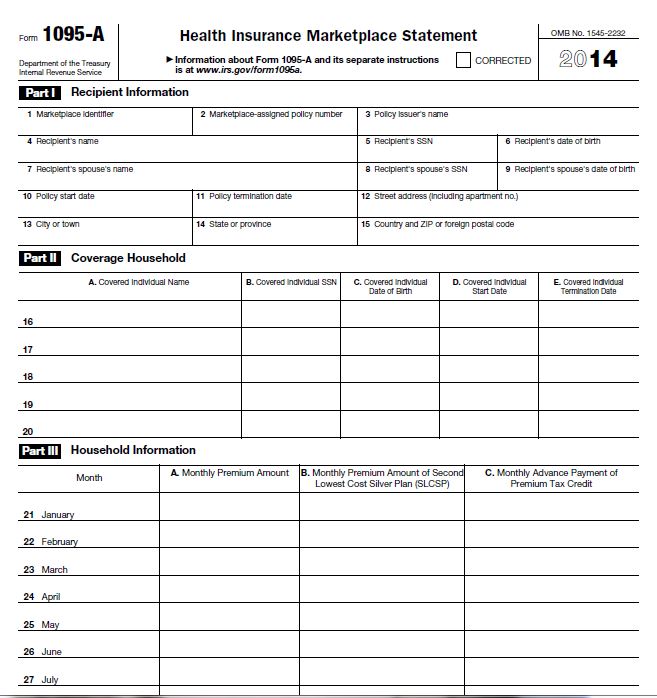

IRS Form 1095-A – Health Insurance Marketplace Statement — is new for the 2014 tax season, and provides details of how much you paid in premiums, how much subsidy you received, and information used to calculate how much subsidy you should have received.

Recently, government officials discovered errors in approximately 800,000 1095-A forms.

Corrected forms will be sent in early March.

What Was the Error on Some 1095-A Forms?

Column B in Part III of the 1095-A statement shows, by month, the premium of the second lowest cost silver plan (SLCSP). SLCSP is used to calculate whether or not you received the right amount of subsidy.

SLCSP is incorrect on some people’s form.

How Will You Know if Your 1095-A is Wrong?

You can sign in to your account on healthcare.gov to find out if your form is affected by the error. Only about 20% of forms contain an error.

What Should You Do if Your 1095-A is Wrong?

If you have already filed your 2014 tax return

The Treasury Department announced that if you already filed your taxes using an incorrect 1095-A, you do not need to refile. Also, in the event that refiling with the corrected form would result in additional taxes, you will not owe anything more.

However, you may want to refile with the corrected form if the corrected SLCSP is higher than the incorrect SLCSP. In that case, you may be be entitled to more money back. Most experts recommend if the difference is slight, it may not be worth the time and expense of refiling. Please consult a tax professional for specific advice.

If you have not yet filed your 2014 tax return

Wait to file your return until you have received your corrected form 1095-A.

Corrected forms are expected to be mailed in early March. Your account on healthcare.gov will also be updated once the corrected form is available.

Visit healthcare.gov’s online tool to find your correct SLCSP if you want to file your taxes before your corrected form arrives.

If you have any questions about your health insurance coverage, please don’t hesitate to call us at (703) 707-8270.

For more information about tax filing with the Affordable Care Act, click here.

Please consult a tax professional for specific tax advice.